From 100 GP Reports to One Dashboard — In Minutes

Altivra Portfolio Copilot helps institutional investors cut through quarterly reporting noise, standardize GP data, and deliver IC memos faster — without drowning in PDFs.

Trusted by investors across Asia.

Designed for sovereign wealth funds, pensions, endowments, and family offices.

Designed by operators with real finance backgrounds — not generic tech vendors.

Built to meet LP due diligence, IC reporting, and ESG requirements.

Every LP faces the same challenge:

-

Overload

Dozens of GP reports arrive quarterly, each in a different format.

-

Manual extraction

Teams copy IRR, MOIC, and DPI into Excel just to compare managers.

-

Slow IC prep

Investment committee memos take weeks to finalize.

-

ESG headaches

ESG data is inconsistent and buried deep in appendices.

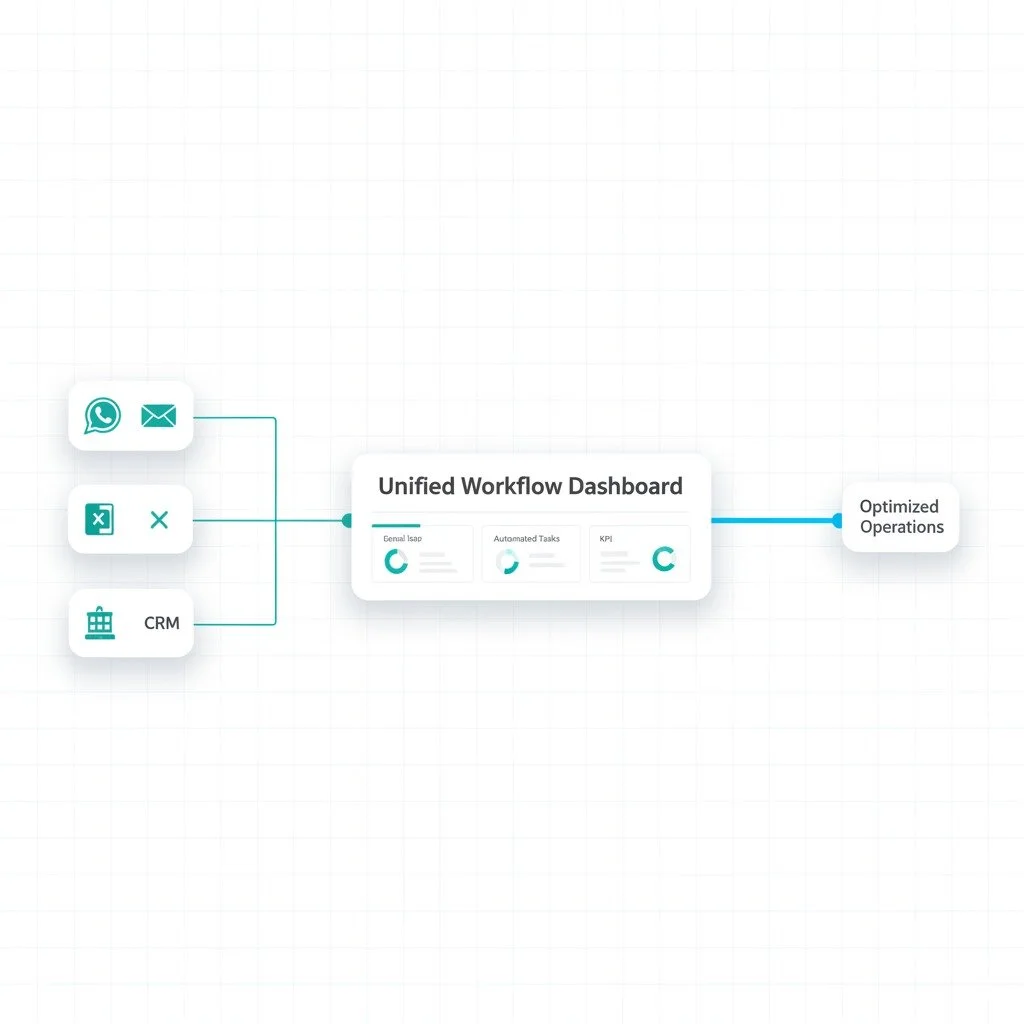

Portfolio Copilot turns chaos into clarity in 3 steps:

-

Ingest

Upload GP reports from inbox, data rooms, or direct feeds (Preqin, PitchBook).

-

Normalize

AI extracts and standardizes IRR, MOIC, DPI, ESG metrics, and benchmarks them across funds.

-

Deliver

Investor-ready outputs: dashboards, 2-page IC memos, and Excel benchmarks.

One Southeast Asian family office standardized 50+ GP reports with Portfolio Copilot and cut analysis time by 62%

Reviewed 67 GP reports in hours, not weeks.

Delivered IC-ready summary in 2 days instead of 3 weeks.

Reduced reporting errors and inconsistencies by 83%.

We’re business operators first, technologists second. That’s why our systems actually get used, deliver ROI, and scale with your business.

Why FUNDS Choose Altivra

Finance-first, not tech-first

Built for deal teams by operators who’ve run deals

Custom taxonomy

Your scoring model, your templates — not an off-the-shelf system.

Fast ROI

LPs see measurable time savings in the first reporting cycle.

Secure by design

Runs inside your VPC or cloud. Data never leaves your environment.

See how fast your fund can move — in just one session

In a quick, no-obligation demo, we’ll show you how Altivra Copilot turns weeks of GP reporting, deal screening, or investor comms into minutes — customized to your workflows and fully secure.

FAQs

Will this replace my analysts?

No. Deal Copilot removes repetitive deck-summarizing work so analysts can focus on diligence, modeling, and conversations — the work that drives returns.

How fast can we see results?

Most funds see IC-ready shortlists in under 14 days. We start with a 30-Day Proof-of-Value, so you get measurable results within the first month.

How secure is this?

Altivra runs inside your cloud or VPC, never outside. Data is encrypted in transit and at rest, with SSO, RBAC, and full audit logs. Nothing is trained on your data.

Will this integrate with the tools we already use?

Yes. We connect directly into your inbox, CRM (DealCloud, Affinity, Salesforce), and portfolio company reports. No new logins, no new platform to learn.

What if this doesn’t fit our fund’s workflow?

That’s expected — every IC is different. Deal Copilot is built around your scoring model, templates, and criteria. If it doesn’t deliver measurable impact, we’ll tell you upfront.

Why shouldn’t I just hire an in-house tech team?

You could — but most in-house builds take months, cost multiples more, and fail to get adoption. With Altivra, you get proven frameworks tailored to funds and you’re live in weeks, not quarters.