From 200 Pitch Decks to 10 IC-Ready Deals — In Minutes

Altivra Deal Copilot helps private equity and venture capital fund managers screen, prioritize, and prepare investment memos faster — without drowning in decks.

Trusted by forward-looking funds across Asia.

Built specifically for private equity and venture capital workflows.

Designed by operators with real finance backgrounds — not generic tech vendors.

Structured to pass LP reviews, IC standards, and compliance checks.

Every GP knows this grind:

-

Too many decks

You receive 200+ pitch decks a quarter — only 1–2 become serious opportunities.

-

Analyst hours wasted

Analysts spend more time summarizing slides than assessing strategy fit.

-

IC frustration

Partners sit through meetings on deals that should’ve been filtered out earlier.

-

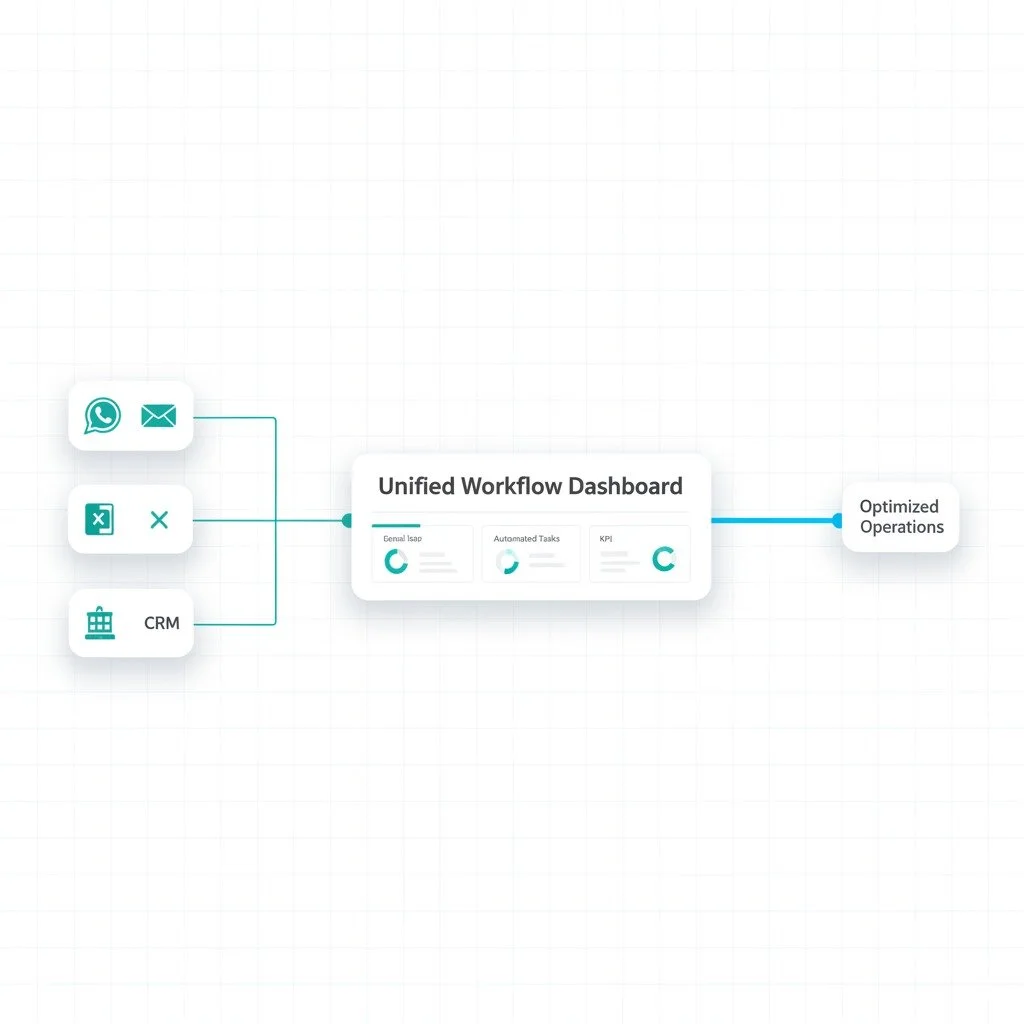

Fragmented information

Emails, CRMs, and Excel trackers scatter critical data.

Deal Copilot turns noise into clarity in 3 steps :

-

Connect

We pull your deal flow directly from your inbox, CRM (DealCloud, Affinity, Salesforce), or data room. No manual chasing.

-

Screen

AI extracts sector, traction, financials, and risk flags. Each deal is scored and ranked against your own IC criteria.

-

Deliver

Investor-ready outputs: IC decks, Excel rankings, and partner digests

A mid-market VC fund in Southeast Asia

cut deal screening time by 70% with Deal Copilot

180 decks → 25 shortlisted → 6 presented to IC.

200+ analyst hours saved per quarter.

Consistent outputs: Every IC deck followed the same structure and scoring.

We’re business operators first, technologists second. That’s why our systems actually get used, deliver ROI, and scale with your business.

Why FUNDS Choose Altivra

Finance-first, not tech-first

Built for deal teams by operators who’ve run deals

Custom to your IC process

Your scoring model, your templates — not an off-the-shelf system.

ROI From Day One

Funds see measurable time savings in their very first quarter.

Secure by design

Runs inside your VPC or cloud. Data never leaves your environment.

See how much faster your fund could move — in just 20 minutes

In a quick, no-obligation session, we’ll show you how Altivra Copilot turns weeks of reporting, screening, or investor comms into minutes — customized to your workflows and fully secure

FAQs

Will this replace my analysts?

No. Deal Copilot eliminates repetitive grunt work so your analysts can spend their time on real diligence, modeling, and conversations with founders — not summarizing decks.

How fast can we see results?

Most funds see IC-ready shortlists in under 14 days. We start with a 30-Day Proof-of-Value, so you get measurable impact within the first month.

How secure is this?

Yes. Altivra runs inside your cloud or VPC, never outside. Data is encrypted in transit and at rest, with SSO, RBAC, and full audit logs. Nothing is trained on your data

Will this integrate with the tools we already use?

Yes. We connect directly into your inbox, CRM (DealCloud, Affinity, Salesforce), and portfolio company reporting files. No new platform to learn, no extra logins

What if AI doesn’t work for my industry?

We’ve worked across insurance, education, and premium services. AI creates impact wherever there are repetitive processes, client interactions, or data flows. And if it truly doesn’t fit your case, we’ll tell you upfront instead of forcing it.

Why shouldn’t I just hire an in-house tech team?

You could — but most internal builds take months, cost multiples more, and often stall because adoption is low. With Altivra, you get proven finance frameworks tailored to funds, and you’re live in weeks, not quarters.